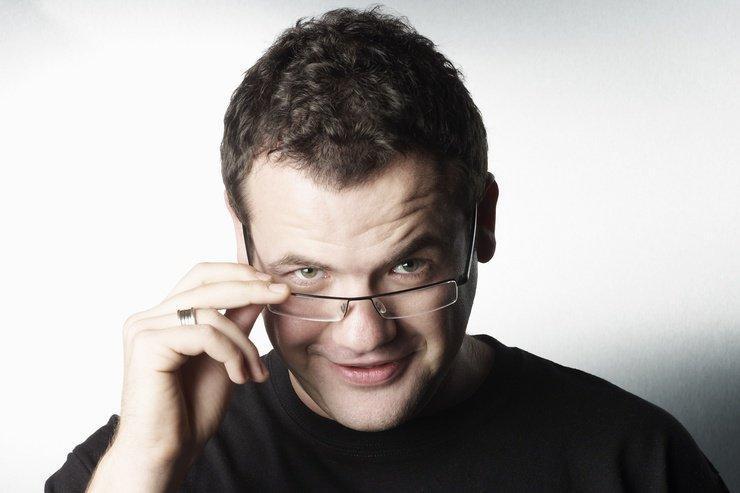

Ruslan Kogan (Kogan)

Excess inventory and an increase in variable costs has impacted online retailer Kogan.com’s net profit, dropping $35.5 million into the red for the 2022 financial year ending 30 June.

Revenue fell 8 per cent down to $718.5 million and earnings before tax (EBITDA) also fell to $21.8 million in the red, while adjusted EBITDA was also down 69.4 per cent to $18.9 million.

In a statement to shareholders, founder and CEO Ruslan Kogan said during the first year of the pandemic sales accelerated and bet the trend wasn’t going to stop. However, he was wrong.

“For more than 10 years, e-commerce grew in Australia at a consistent and stable rate. This enabled Kogan.com to plan for growth in a measured and precise way,” Kogan said.

“The consistency of this growth was rocked by the onset of the COVID-19 pandemic, when customers turned to Kogan.com, and we found that — almost overnight — our business started to double in sales.

“Kogan.com quickly became the destination that millions of Australians relied on for the most essential items. This acceleration of sales continued for many months in the first year of the pandemic and we bet that the trend was not going to stop.

“To ensure we could be there for our customers when they needed us most, we increased both our range and volume of inventory, as well as our logistics footprint to match this expected level of growth.

But Kogan said as the true volatility of the situation settled in caused by stay at home orders and lockdown ambiguity, e-commerce did not continue to grow as anticipated.

“This led to us holding excess inventory and an associated increase in variable costs and marketing costs to sell through the inventory. As we’ve discussed at length through regular updates this past year, profitability was impacted,” he said.

The impact of inflation on delivery costs has also resulted in the price of its Kogan First membership increasing to $79 per year.

Total inventories at 30 June 2022, was $159.9 million with $137.9 million in warehouse and $22 million in transit. This is a significant unwinding of total inventories from the previous year, which were $227.9 million.

Kogan Mobile saw a slight uptick in growth in Australia and the company anticipates further growth as international borders reopen and enhancements take place, such as the trial of 5G on all large and extra large Kogan Mobile Australia plans.

Kogan Mobile New Zealand was also experiencing growth at 130 per cent and is expected to continue into the new financial year.

Read more: Deloitte reveals 2013 Technology Fast 50 winners